Wealthy benefits usually entail good dangers, and the exact same is true with the highly unstable cryptocurrency market. The uncertainties in 2020 globally resulted in a heightened interest of masses and large institutional investors in trading cryptocurrencies, a new-age asset class. Raising digitization, flexible regulatory structure, and great judge raising bar on banks working with crypto-based companies have parked opportunities in excess of 10 million Indians within the last year. Many significant worldwide cryptocurrency exchanges are definitely scouting the Indian crypto market, which has been showing a sustained surge in day-to-day trading quantity within the last year amid a large decline in prices as numerous investors viewed value buying. While the cryptocurrency frenzy continues, several new cryptocurrency exchanges attended up in the country that allows getting, selling, and trading by providing efficiency through user-friendly applications. WazirX, India's biggest cryptocurrency trading program doubled their people from million to two million between January and March 2021.

What's Driving World's Greatest Crypto Transactions to the Indian market?

In 2019, the world's greatest cryptocurrency change by deal size, Binance purchased the Indian industry system, WazirX. Yet another crypto launch, Coin DCX attached investment from Seychelles-based BitMEX and San-Francisco based-giant Coinbase. The crypto and blockchain start-ups in India have attracted investment of USD99.7 million by June 15, 2021, which totaled around USD95.4 million in 2020. In the last five years, world wide investment in the Indian crypto market has improved with a huge 1487%.

Despite India's uncertain policy, global investors are creating huge bets on the country's electronic coin environment due to a number of factors such as

• Tech-savvy Indian Populace

The predominant population of 1.39 million are small (median era between 28 and 29 years) and tech-savvy. Whilst the older era still wants to buy silver, real estate, patents, or equities, the newer people are adopting the high-risk cryptocurrency exchanges because they are more convenient to them. India rates 11th on Chainalysis's 2020 record record for global ownership of crypto, which shows the excitement about crypto among the Indian population. Nor does the less-than-friendly perspective of the federal government towards crypto or rumors swirling round the crypto have the ability to move the self-confidence of the youth populace in the electronic cash market.

India offers the least expensive web on earth, where one gigabyte of mobile knowledge expenses about $0.26 while the worldwide normal is $8.53. So, nearly half the billion consumers are benefiting from economical internet access, which improves India's potential to become one of the greatest crypto economies in the world. Based on SimilarWeb, the united states is the second-largest supply of internet traffic to peer-to-peer bitcoin trading software, Paxful. As the popular economy continues to be striving from the "pandemic effect", cryptocurrency is getting momentum in the country since it provides the small generation a brand new and fast way of earning money.

It's safe to express that cryptocurrency may become Indian millennials what silver is due to their parents!

• Increase of Fintech Start advantages

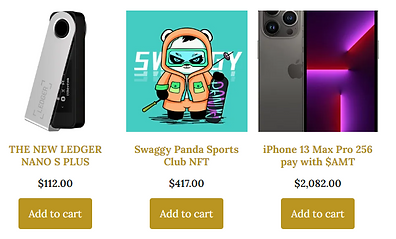

The cryptocurrency fad generated the emergence of multiple trading tools such as WazirX, CoinSwitch, CoinDCX, ZebPay, Unocoin, and many others. These cryptocurrency exchange tools are very attached, available across various systems, and let quick transactions, providing a friendly interface for crypto lovers to buy, provide, or trade digital assets limitlessly. Many of these platforms take INR for buys and trading fees as little as 0.1% therefore simple, quickly, and protected programs present a lucrative chance for both first-time investors and local traders.

WazirX is one of the leading cryptocurrency change programs with around 900,000 users that delivers clients with peer-to-peer exchange capabilities. CoinSwitch Kuber provides the best cryptocurrency exchange platform for Indians and is ideal for newcomers along with daily doers. Unocoin is one of many oldest cryptocurrency exchange platforms in India that account fully for around a million traders through cellular applications. CoinDCX provides consumers with 100+ cryptocurrencies as an alternative to produce transactions and actually gives investors with insurance to cover deficits in the event of a security breach. So, international investors are eyeing the array of cryptocurrency exchange platforms in India to make the most of the emerging market.

• Combined Government Response

The legislative statement regarding a ban against a virtual currency that could criminalize anyone engaged in possession, issuance, mining, trading, and transferring crypto resources may get enacted in to law. Nevertheless, Fund and Corporate Affair Minister Nirmala Sitharaman eased some investor's issues stating that the government hasn't in the pipeline to totally club cryptocurrency use. In a statement given to a leading English newspaper, Deccan Herald, the Money Minister said, "From our part, we're very clear that individuals aren't closing all options. We will allow specific windows for folks to accomplish experiments on the blockchain, bitcoins, or cryptocurrency." It's evident that the us government is still scrutinizing the national security dangers sat by cryptocurrencies before choosing putting a complete ban.

In March 2020, the Great court overturned the main bank's decision to bar financial institutions from working in cryptocurrencies, which prompted investors to pack into the cryptocurrency market. Regardless of the ongoing anxiety about ban, deal volumes continued to enlarge, and individual enrollment and money inflows at local crypto-exchange turned 30-fold from a year ago. Certainly one of India's earliest transactions, Unocoin included 20,000 people in January and February of 2021. The sum total level of Zebpay daily of Feb 2021 got equal to the quantity generated in the complete month of March 2020. Approaching the cryptocurrency situation in India, the Fund Minister claimed in a CNBC-TV18 appointment, "I can only just offer you this hint that people are not ending our heads, we are looking at ways where studies sometimes happens in the digital world and cryptocurrency."

Rather than sitting on the side-lines, investors and stakeholders need to help make the most readily useful of proliferating the digital money environment until the government presents the ban on "private" cryptocurrency and introduced sovereign digital currency.

Is India Heading Towards Economic Inclusivity with Cryptocurrency?

After regarded a "Boys club" as a result of commonplace man population proposal in the cryptocurrency industry, the slowly rising number of women investors and traders has led to more sexuality neutrality in the new and electronic type of expense methods. Early in the day, girls used to stick to conventional opportunities but now they are becoming risk-takers and venturing to the crypto room in India. After the pinnacle court solved the legality of "virtual currency", the Indian cryptocurrency software, CoinSwitch seen an exponential 1000% upsurge in their girls users. While women investors however constitute a small percentage of the crypto community, they're putting up brutal opposition in the Indian market. Women tend to save lots of much more than their guy counterparts and more savings means more range in opportunities such as for example high-return assets like cryptocurrencies. Also, girls are more analytical and greater at assessing risks prior to making the best expense choices, so they are more effective investors.

Increasing Mainstream Institutional Adoption of Cryptocurrencies

Uncertainty and panic aroused by SARS-Covid 19 generated a liquidity crisis even before the economic disaster collection off. Many investors converted their holdings in to income to shield their finances, which resulted in the collapsed rates of bitcoin and altcoin. But although crypto endured a significant crash, it still managed to be the most effective doing advantage school of the entire year 2020. With the increased weakness of the device and loss of trust in the policies of the key bank and profit their recent style, individuals have an increased hunger for electronic currencies which resulted in the rebound of cryptocurrency. Due to the stellar performance of cryptocurrency in the midst of the international financial situation, the uptrend has strengthened fascination with the electronic currency market in Asia and the rest of the world.

Moreover, to energy society's demand for convenient and reliable deal solutions, electronic payment gateways such as PayPal have revealed their support towards cryptocurrencies that could permit customers to put up, buy, or offer with virtual assets. Recently, Tesla CEO Elon Musk built an story of investment in the cryptocurrency industry worth USD1.5 billion, and that the electric business might take bitcoin from consumers, which resulted in an international bitcoin value jump from USD40,000 to USD48,000 within two days. Two of the largest platforms crypto passive income platform for making funds across the world, Credit and Mastercard are also endorsing cryptocurrencies by presenting them as a moderate to create transactions. While Credit has recently produced the statement of allowing transactions with stable coins on the Ethereum blockchain, Mastercard could begin transactions with crypto sometime in 2021.

What does the future maintain for the Cryptocurrency industry in India?

The Indian cryptocurrency industry is not resistant to the bad crypto crashes. Despite humongous expense from world wide counterparts, regional investors remain sustaining range from crypto opportunities as a result of uncertainty about the legality of the digital money ecosystem in India as well as the large volatility of the market. Although the cryptocurrency market is growing since this past year, Indians possess less than 1% of the world's bitcoin, which generates a proper drawback for the Indian economy. The Indian government is likely to appoint a fresh section to examine the likelihood of regulating electronic currencies in the united states as well as focus on blockchain technology and propose it for technological enhancements.

The capacity of blockchain technology to provide a safe and immutable infrastructure has been noticed by different industries to instill transparency in transactions. For a nation with more than 15 million crypto adopters, the brand new suggestion from the committee could maintain great price to find out the future of cryptocurrency in India. However, the stakeholders believe that the complex and financial energy can make India a vital participant in the crypto and blockchain market. Gradually, the cryptocurrency is getting popular acceptance, which may cause to higher ownership of electronic currency.